Square chargebacks are a headache for eCommerce sellers. You can fight such false claims, but that involves additional labor and costs as you must provide compelling evidence to the issuer about the legitimacy of each transaction. dissatisfaction, buyer’s remorse, forgetfulness), leaving you to foot the bill. Some users attempt to recoup payments for less-than-honest reasons (e.g. Plus, a significant number of cardholders abuse the consumer protections offered via chargebacks, activity known as friendly fraud. Not only do you lose the reversed sale, but there are extra chargeback fees and processing costs. The eCommerce payment ecosystem only works if cardholders feel safe to use their credit cards.īut for merchants, the chargeback process is a complicated and expensive nuisance. Consumers should not have to pay for incorrect or fraudulent card activity. The entire credit card chargeback process helps protect consumers from the financial damage of unauthorized transactions. The issuer initiates a chargeback and notifies Square, who then debits the amount out of your merchant account. a fraudulent transaction, an incorrect charge, an unknown billing name), they can call their issuer and ask for a reversal. If a customer has an issue with a listed credit card charge (e.g. Square chargebacks are consumer disputes that occur over the Square payment network. Let’s explore Square chargeback protection and how Square addresses chargebacks for you and your business. In response, Square has developed seller safeguards for its users. Chargebacks are costly, complex, and time-consuming fund reversals-and the issue continues to grow in volume and scope as demand for online payments expands. Both enterprise and small business owners now use Square to enable a host of credit card payment-related services, including point-of-sale, virtual terminals, and online checkouts.īut since Square gives its users access to credit and eCommerce payment systems, it exposes merchants and vendors who use the service to chargebacks. What began as a simple smartphone-capable credit card reader has become a prominent, multinational eCommerce technology corporation. Since I’m new to regular use of Square, I’m guessing that I just haven’t found the right link to get this information for my records.Square is a popular payment processor. I previously used PayPal which gave me the amount invoiced and paid, the amount of the fee, and the resulting amount deposited to my account.

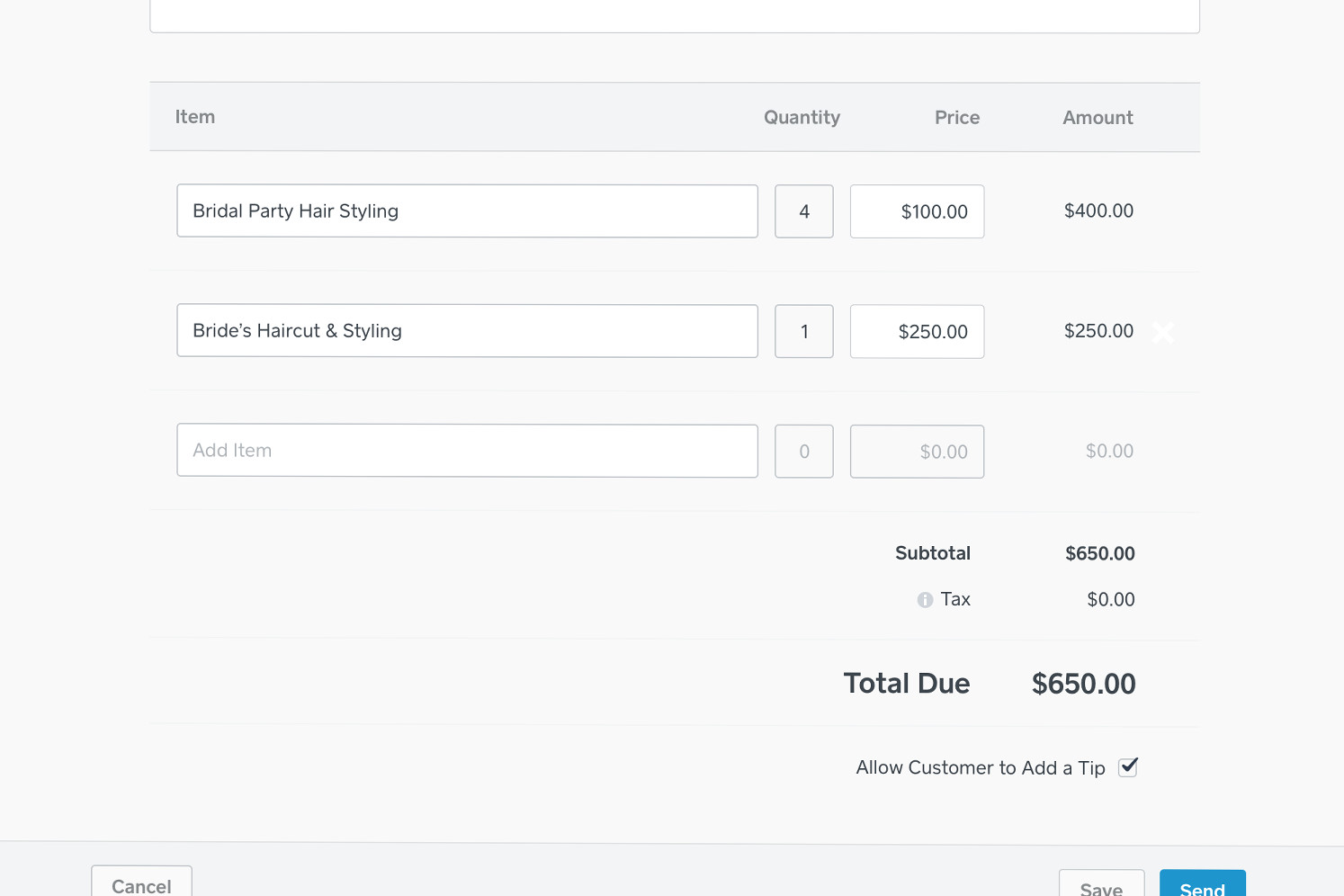

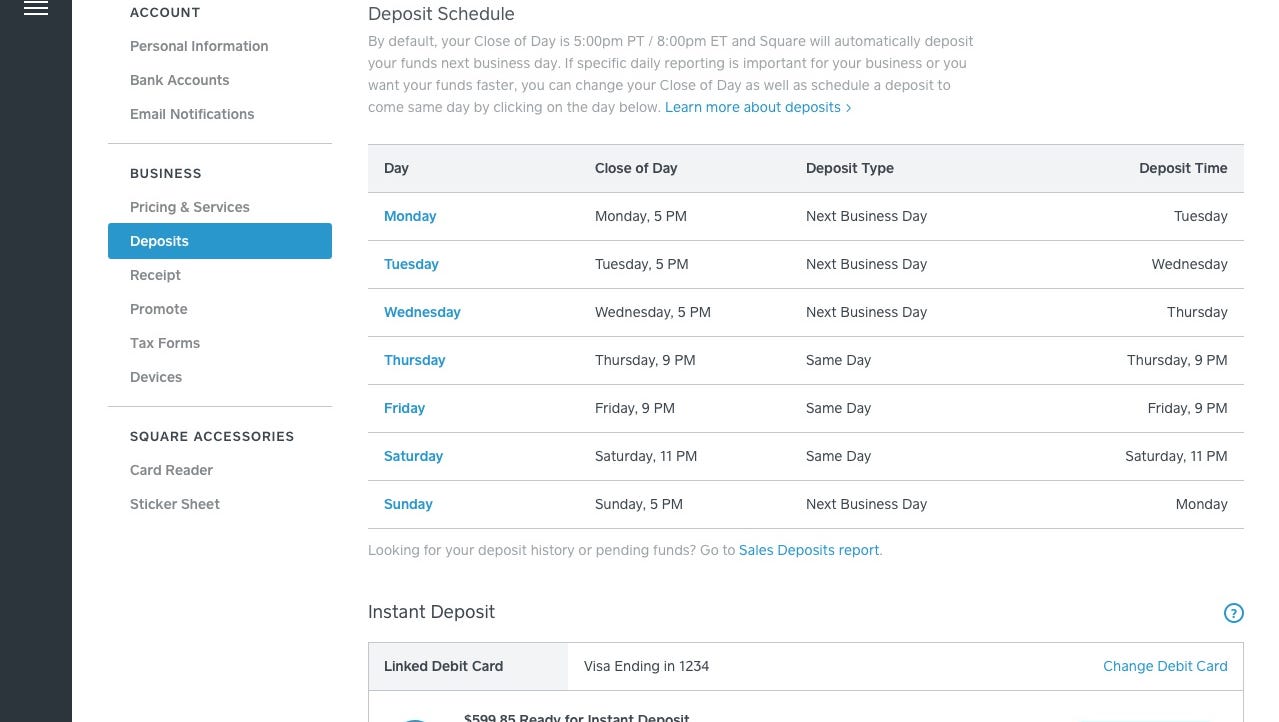

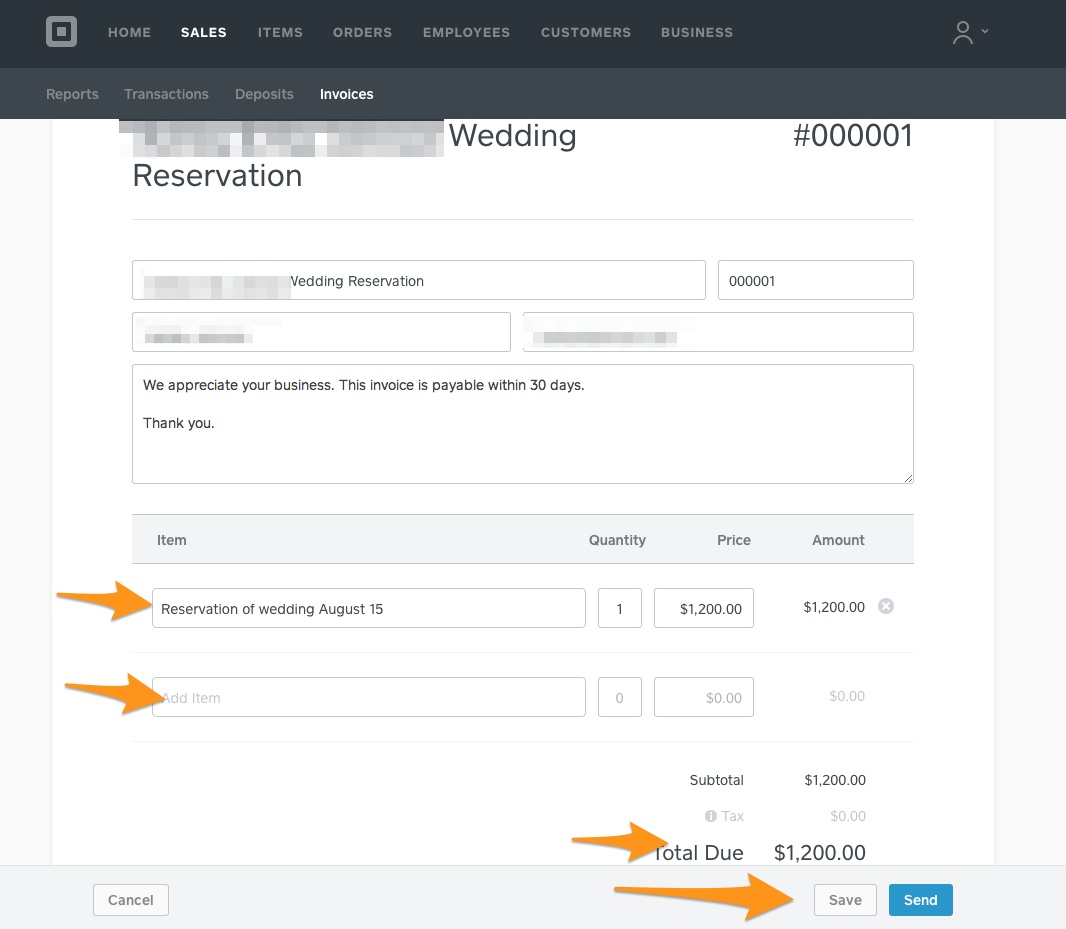

It’s not difficult but seems like an unnecessary extra step. So what I have been doing is subtracting the amount of my deposit from the amount of the invoice to get the amount of the fee. To keep track of my expenses for my taxes, and to reconcile my checking account, I need to keep track of the amount of each processing fee. Then I receive a notice of payment, followed by a notice of the amount deposited to my account. What I receive now from Square is a copy of my invoice with the amount I charged my client.

I’ve just switched to Square for invoicng my clients as of March 1st.

0 kommentar(er)

0 kommentar(er)